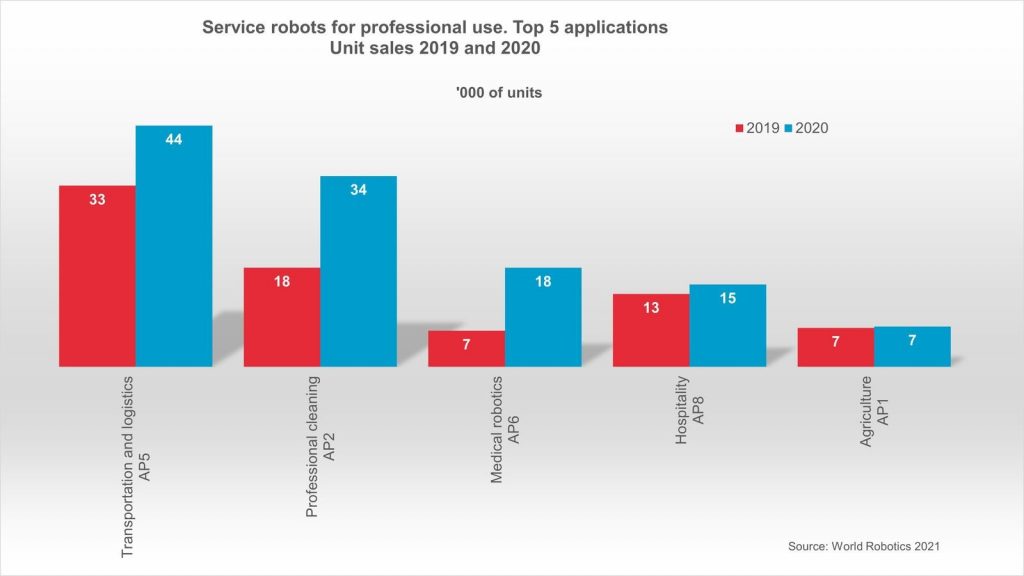

The market for professional service robots reached a turnover of 6.7 billion U.S. dollars worldwide (sample method) – up 12% in 2020. At the same time, turnover of new consumer service robots grew 16% to 4.4 billion U.S. dollars. This is according to World Robotics 2021 – Service Robots report, presented by the International Federation of Robotics (IFR).

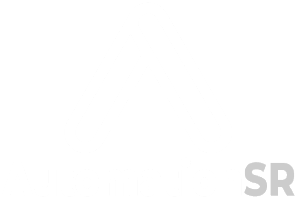

TOP 5 Application in Service Robotics © World Robotics

“Service robots continued on a successful path proving the tremendous market potential worldwide,” says IFR President Milton Guerry. “Sales of professional service robots rose an impressive 41% to 131,800 units in 2020.”

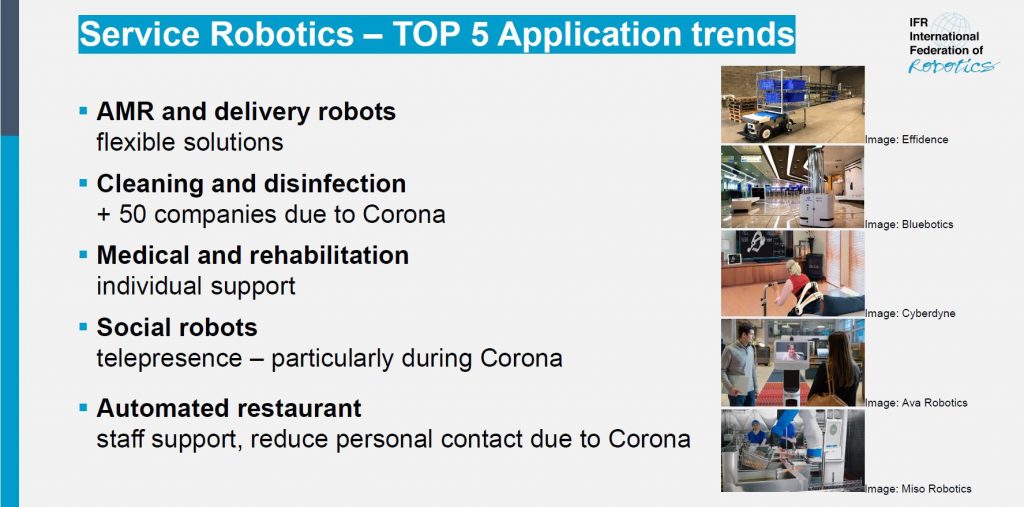

Five top application trends for professional service robots were driven by extra demand of the global pandemic:

© IFR International Federation of Robotics

One out of three units were built for the transportation of goods or cargo. Turnover for Autonomous Mobile Robots (AMR) and delivery robots grew by 11% to over 1 billion US dollars. Most units sold operate in indoor environments for production and warehouses. The trend goes towards flexible solutions, so that the AMR´s act in mixed environments together e.g. with forklifts, other mobile robots or humans. There is also a strong market potential for transportation robots in outdoor environments with public traffic, e.g. lastmile delivery. Marketing and monetarization options will depend on the availability of regulatory frameworks which currently still prevent the large-scale deployment of such robots in most countries.

Demand for professional cleaning robots grew by 92% to 34,400 units sold. In response to increasing hygiene requirements due to the Covid-19 pandemic, more than 50 service robot providers developed disinfection robots, spraying disinfectant fluids, or using ultraviolet light. Often, existing mobile robots were modified to serve as disinfection robots. There is a high ongoing potential for disinfection robots in hospitals and other public places. Unit sales of professional floor cleaning robots are expected to grow by double-digit rates on average each year from 2021 to 2024.

In terms of value, the sales of medical robotics accounts for 55% of the total professional service robot turnover in 2020. This was mainly driven by robotic surgery devices, which are the most expensive type in the segment. Turnover increased by 11% to 3.6 billion U.S. dollars.

A tremendously growing number of robots for rehabilitation and non-invasive therapy make this application the largest medical one in terms of units. About 75% of medical robot suppliers are from North America and Europe.

The global pandemic created additional demand for social robots. They help e.g. residents of nursing homes to keep contact with friends and family members in times of social distancing. Communication robots provide information in public environments to avoid personal human contact, connect people via video for a business conference or help with maintanance tasks on the shopfloor.

Hospitality robots enjoy growing popularity generating turnover of 249 million US dollars. Demand for robots for food and drink preparation grew tremendously – turnover almost tripled to 32 million US dollars (+196%). The Covid-19 pandemic created increased awareness to avoid contact with food products. There is still a huge potential for hospitality robots with medium double-digit annual growth predicted.

Service robots for consumer use

Robots for domestic tasks are the largest group of consumer robots. Almost 18.5 million units (+6%), worth 4.3 billion US dollars, were sold in 2020.

Robot vacuums and other robots for indoor domestic floor cleaning were up 5% to more than 17.2 million units with a value of 2.4 billion US dollar. This kind of service robot is available in almost every convenience store, making it easily accessible for everyone. Many American, Asian, and European suppliers cater to this market.

Gardening robots usually comprise lawn mowing robots. This market is expected to grow by low double-digit growth rates on average each year in the next few years.

Service robotics industry structure

“The service robot industry is developing at a high pace,“ says IFR President Milton Guerry.” “Lots of start-up companies appear every year, developing innovative service robot applications and improving existing concepts. Some of these young companies disappear as quickly as they emerged. The activity remained high in the service robotics space with acquisitions by incumbents and acquisitions by companies from industries with a desire to expand and work in this exciting area.”

Company structure of service robot manufacturers © World Robotics 2021

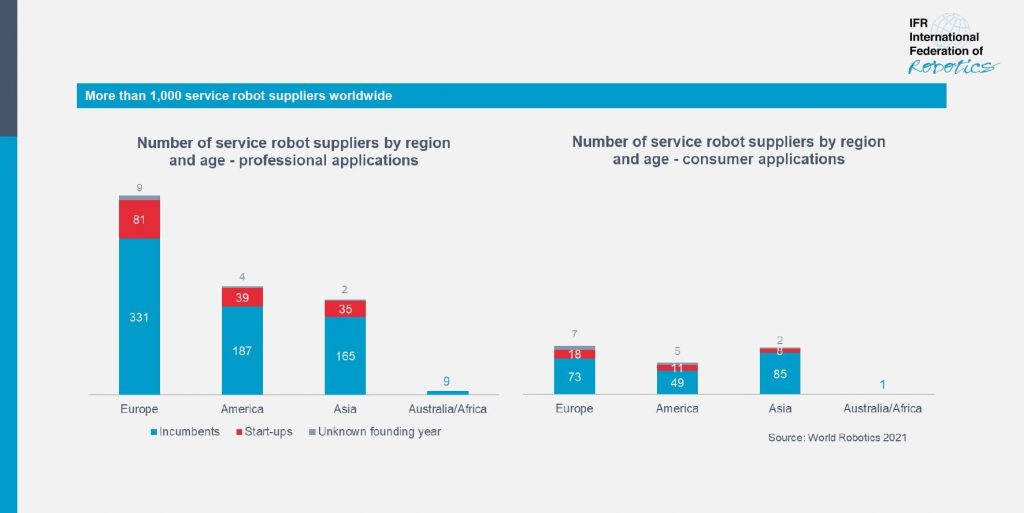

Worldwide, 80% of the 1.050 service robot suppliers are considered incumbents that were established more than five years ago. 47% of the service robot suppliers are from Europe, 27% from North America and 25% from Asia.

World Robotics 2021 edition

Orders for World Robotics 2021 Industrial Robots and Service Robots reports can be placed online. Further downloads on the content are available here.

Downloads

Graphs, presentations and German press release are available below:

tags: Report

International Federation of Robotics (IFR) connects the world of robotics around the globe. We aim at promoting the positive benefits of robots for productivity, competitiveness, economic growth and quality of work and life.